Your trusted real estate agent often plays a crucial role in property transactions – sourcing listings or representing your interests as a seller. Within a 1031 exchange, their expertise remains valuable, but additional collaboration is key. As not all realtors understand the unique rules of these tax-deferred transactions, here’s how to set yourself (and your agent) up for success:

The Early Talk: Disclosing Your 1031 Exchange Intent

Whether you’re selling or buying, upfront communication about your 1031 exchange avoids later complications. Here’s what to mention initially:

- Deadlines: Emphasize the 45-day identification and 180-day closing timelines.

- Qualified Intermediary: Explain that your proceeds from the sale of the relinquished property may need to be held by a special facilitator (your Qualified Intermediary) throughout the process.

- Purchase Agreements: Mention that specific “tax-deferred exchange” language may need to be included in contracts and offers.

Proactive Guidance for Your Realtor

Your involvement helps bridge knowledge gaps for a smoother exchange:

- Qualified Intermediary Contact: Provide your QI’s contact info to your realtor – early coordination is valuable.

- Title Company Liaison: Some qualified intermediaries work with specific title companies familiar with 1031 exchange logistics. If that’s the case, inform your realtor early in the process.

- Listing Side Considerations: Ensure your agent understands there can’t be direct receipt of sales proceeds, nor typical negotiations on earnest money deposits as all funds might be bound by the exchange agreement.

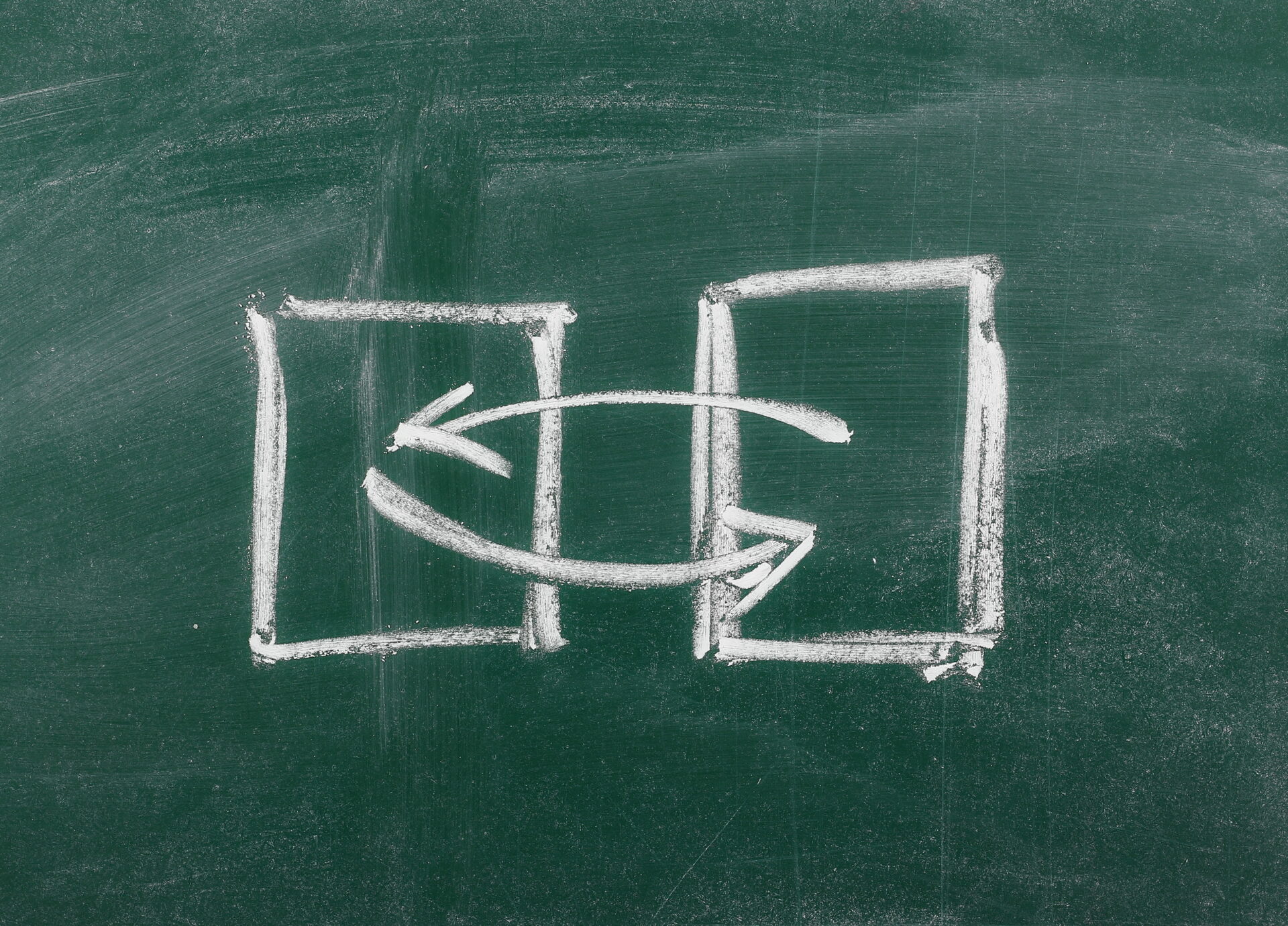

The Ideal 1031 Exchange Team: Realtor, QI, & You

Remember, many realtors WILL want to be helpful within these processes once given guidance. A team approach combines strengths:

- Your realtor’s property knowledge and ability to navigate a timely selling or buying process.

- Your qualified intermediary’s expertise in regulatory paperwork and facilitating fund transfer.

- Your informed leadership as the exchanger with oversight for your tax-deferral goals.

WealthBuilder 1031 – Beyond Facilitation, We Provide Client Support

Our team believes informed clients have successful exchanges. Have questions about working with your realtor (or need us to assist in a conversation)? Our Wealthbuilder 1031 team is here to guide you throughout your transaction. Simply contact us at (888) 508-1901 to get started.

Same-Day Drop and Swap Survives in New York: What Real Estate Investors Need to Know

Real Estate Agents and 1031 Exchanges: A Crucial Partnership