Table of contents

- What Is a Reverse 1031 Exchange?

- How Does a Reverse 1031 Exchange Work?

- Key Rules and Regulations You Need to Know

- The Role of the Qualified Intermediary (QI)

- Pros and Cons of Reverse 1031 Exchanges

- When Should You Consider a Reverse 1031 Exchange?

- Costs and Fees Associated with Reverse 1031 Exchanges

- Common Pitfalls and Mistakes to Avoid

- Final Thoughts on Reverse 1031 Exchanges

If you’re new to real estate investing, you might have heard of a 1031 exchange. This is where you sell a property and reinvest the proceeds into another “like-kind” property while deferring capital gains taxes. But what happens if you want to buy first and sell later? That’s where the reverse 1031 exchange comes in. To help you navigate this process, we’ve put together this reverse 1031 exchange guide.

In this guide, I’ll walk you through everything you need to know about reverse 1031 exchanges, from what they are to how they work and why you might consider one. As a real estate investment expert, I’ll break it down in a casual, easy-to-follow way, so whether you’re just starting out or looking for more advanced strategies, you’ll leave with a better understanding of this powerful tool.

What Is a Reverse 1031 Exchange?

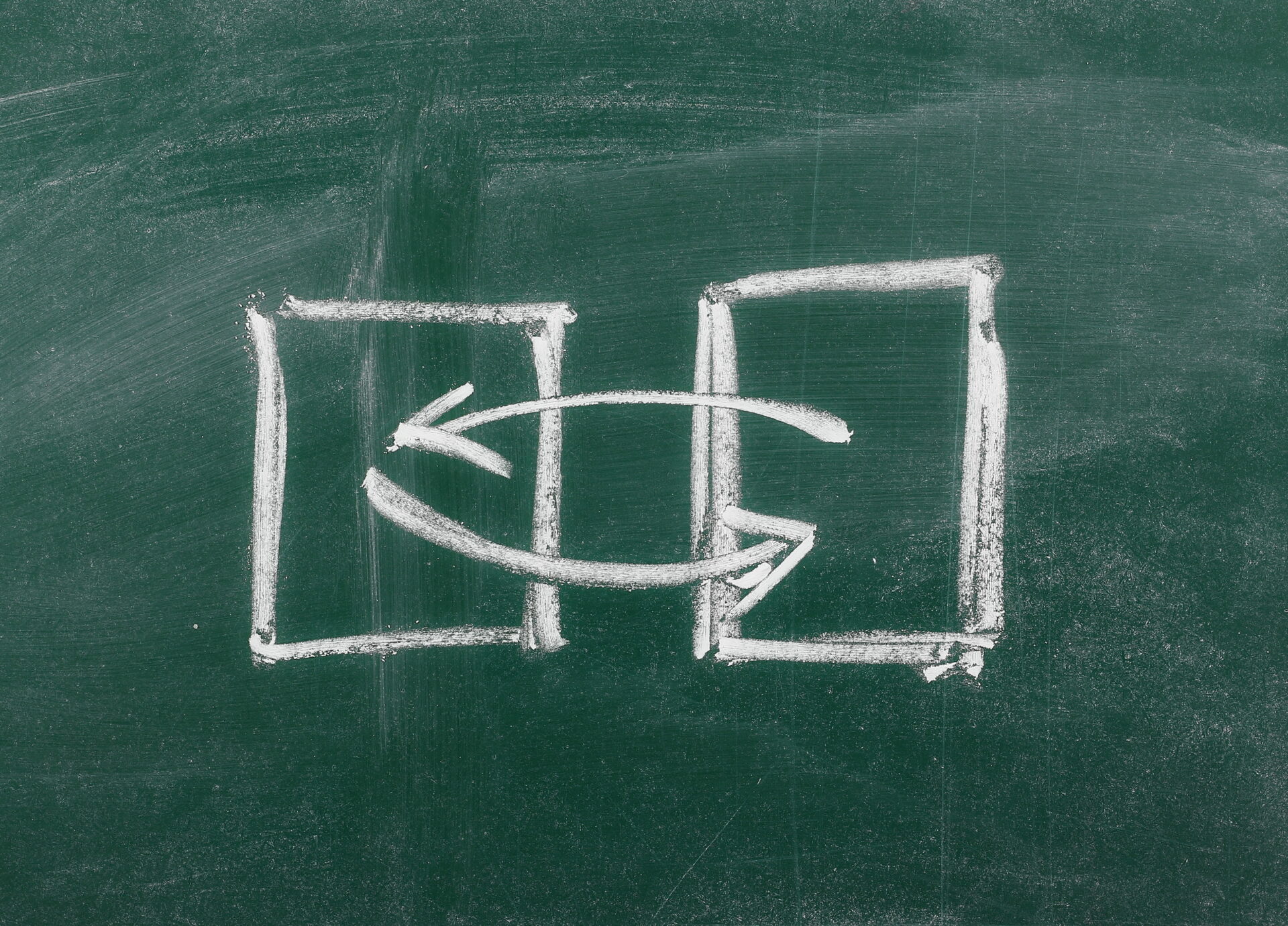

Let’s start with the basics. A reverse 1031 exchange is exactly what it sounds like: you buy your replacement property first and sell the property you’re getting rid of afterward. This is the opposite of the traditional 1031 exchange, where the relinquished property is sold before the replacement is purchased.

The key benefit here is flexibility. In a traditional 1031 exchange, you’re under pressure to find a new property fast (you have 45 days to identify and 180 days to close). With a reverse exchange, you have more breathing room because you can secure your replacement property first, ensuring you don’t miss out on a good deal. The trade-off? Reverse exchanges can be more complicated and expensive, but we’ll get into that later.

Why Would You Use a Reverse 1031 Exchange?

A reverse 1031 exchange can be ideal in several situations:

- Tight real estate markets: If the market is hot and you find the perfect replacement property before you’ve sold your current property, a reverse exchange lets you lock in that deal.

- Avoiding rushed sales: If you’re struggling to sell your current property, a reverse exchange gives you time to wait for the right buyer instead of being forced into a fire sale.

- High demand for specific properties: Maybe you’ve been eyeing a replacement property for months, and you’re worried it’ll be snatched up before you can sell your old property. A reverse exchange can solve that problem.

How Does a Reverse 1031 Exchange Work?

Now let’s dive into how this process works. A reverse exchange is a bit more complex than a traditional 1031 exchange, so understanding the steps is crucial.

Step 1: Purchase the Replacement Property

In a reverse exchange, you start by purchasing the replacement property. Since you haven’t sold your current property yet, you can’t hold both properties in your name at the same time and still qualify for the 1031 exchange. Here’s where an important player comes into the picture: the Exchange Accommodation Titleholder (EAT).

Step 2: The Role of the Exchange Accommodation Titleholder (EAT)

The EAT is a third party that temporarily holds the title to either the property you’re buying or the one you’re selling. This arrangement allows you to follow the IRS rules and not hold both properties at the same time, which is a requirement for a valid 1031 exchange.

You essentially buy the new property, but the EAT holds onto it while you work on selling your old property. You won’t lose control. While the EAT holds title, you get to manage and use the property as if it were your own.

Step 3: Sell the Relinquished Property

Once you’ve secured the replacement property, it’s time to sell your current (or relinquished) property. You still need to meet the IRS’s strict 45-day identification rule and 180-day exchange period. What does that mean?

- 45-Day Rule: You have 45 days from when you buy the replacement property to identify the property you’re going to sell (the relinquished property).

- 180-Day Rule: You then have 180 days from the date you bought the replacement property to complete the sale of your relinquished property and finalize the exchange.

If you don’t meet these deadlines, your exchange could fail, and you’d be stuck paying capital gains taxes.

Step 4: Transfer of Title

Once you’ve sold the relinquished property, the EAT transfers the title of the replacement property to you, and the exchange is complete. This is when you can finally celebrate; you’ve successfully completed a reverse 1031 exchange!

Key Rules and Regulations You Need to Know

Understanding the IRS rules is critical when dealing with a reverse exchange. The IRS is pretty strict about deadlines, and mistakes can be costly.

The 45/180-Day Rule

As I mentioned earlier, you have 45 days to identify the property you’re going to sell after purchasing the replacement property and 180 days to complete the sale. These timelines apply just like they would in a traditional 1031 exchange, and they’re non-negotiable. Miss them, and you lose the benefits of the exchange – meaning you’ll be on the hook for capital gains taxes.

Qualified Intermediaries (QIs) and EATs Are Required

A reverse exchange is not a DIY project. The IRS requires the involvement of a Qualified Intermediary (QI), and as mentioned, you’ll need an Exchange Accommodation Titleholder (EAT) to hold the title of one of the properties during the exchange process. If you work with WealthBuilder 1031, we will take care of both of these roles for you.

You can’t serve as your own QI or EAT, and trying to skip this step will disqualify the exchange. That’s why it’s crucial to work with professionals who are experienced in 1031 exchanges.

The Role of the Qualified Intermediary (QI)

The Qualified Intermediary (QI) plays a crucial role in the success of your reverse exchange. The QI is responsible for:

- Holding the proceeds from the sale of your relinquished property in a traditional 1031 exchange.

- Coordinating the exchange with the EAT in a reverse exchange.

- Ensuring all IRS deadlines and regulations are met.

Without a QI, you can’t complete a reverse exchange. They act as a middleman to keep you in compliance with IRS rules and handle the technical details that can easily trip up a DIY approach.

Pros and Cons of Reverse 1031 Exchanges

Pros

- Flexibility: Buying the replacement property first gives you more control and flexibility over your investment decisions. You don’t have to worry about selling your old property before securing a new one.

- No rush to sell: A reverse exchange allows you to wait for the right buyer for your relinquished property, avoiding the pressure to sell quickly.

- Maximizing investment opportunities: By securing the replacement property when you find a great deal, you avoid missing out on good opportunities.

Cons

- Higher costs: Reverse exchanges are more expensive than traditional exchanges due to the need for an EAT and additional professional services.

- Financing challenges: You may need to secure short-term financing or bridge loans to cover the costs of holding both properties during the exchange period.

- Complexity: The reverse exchange process is more complicated, and there’s less room for error. Working with experienced professionals is a must.

When Should You Consider a Reverse 1031 Exchange?

A reverse 1031 exchange might be a good option for you if:

- The market is hot, and you’ve found a perfect replacement property but haven’t sold your current property yet.

- You want to take your time selling the relinquished property without rushing the process.

- The property you’re selling is in a market with limited buyer demand, but you want to secure a replacement in a competitive market.

If any of these scenarios sound like you, a reverse exchange could be worth considering.

Costs and Fees Associated with Reverse 1031 Exchanges

It’s no secret. Reverse 1031 exchanges can be pricey. Here’s a breakdown of typical costs:

- Qualified Intermediary fees: QIs charge fees for their services, which can vary depending on the complexity of the exchange.

- EAT fees: Since an EAT will be holding the title of one of your properties, you’ll need to pay for their services as well.

- Legal and administrative fees: You may need to hire legal and tax advisors to ensure everything is done correctly, especially with the complex nature of a reverse exchange.

Altogether, the cost of a reverse exchange can be thousands of dollars more than a traditional exchange. However, for investors who need the flexibility to buy first and sell later, the extra cost can be well worth it.

Common Pitfalls and Mistakes to Avoid

It’s easy to make mistakes with reverse 1031 exchanges, especially if you’re new to the process. Here are some common pitfalls to watch out for:

- Missing deadlines: The 45-day identification rule and 180-day exchange period are hard deadlines. Miss them, and you could be facing a tax bill.

- Financing issues: Securing financing to cover the purchase of the replacement property while holding onto the relinquished property can be challenging. Make sure you have financing lined up before starting the process.

- Not working with experienced professionals: A reverse exchange is complex, and trying to handle it yourself without the right team can lead to costly mistakes.

Final Thoughts on Reverse 1031 Exchanges

A reverse 1031 exchange can be a powerful tool for real estate investors, offering flexibility and control when buying and selling properties. While the process is more complicated and expensive than a traditional exchange, it can be a great option if you want to secure a new property without the pressure to sell your old one right away.

Just remember, working with an experienced Qualified Intermediary and legal/tax professionals is essential for a smooth transaction. If you think a reverse exchange is the right strategy for you, make sure you have the right team in place to guide you through the reverse 1031 exchange process.

Same-Day Drop and Swap Survives in New York: What Real Estate Investors Need to Know

Real Estate Agents and 1031 Exchanges: A Crucial Partnership