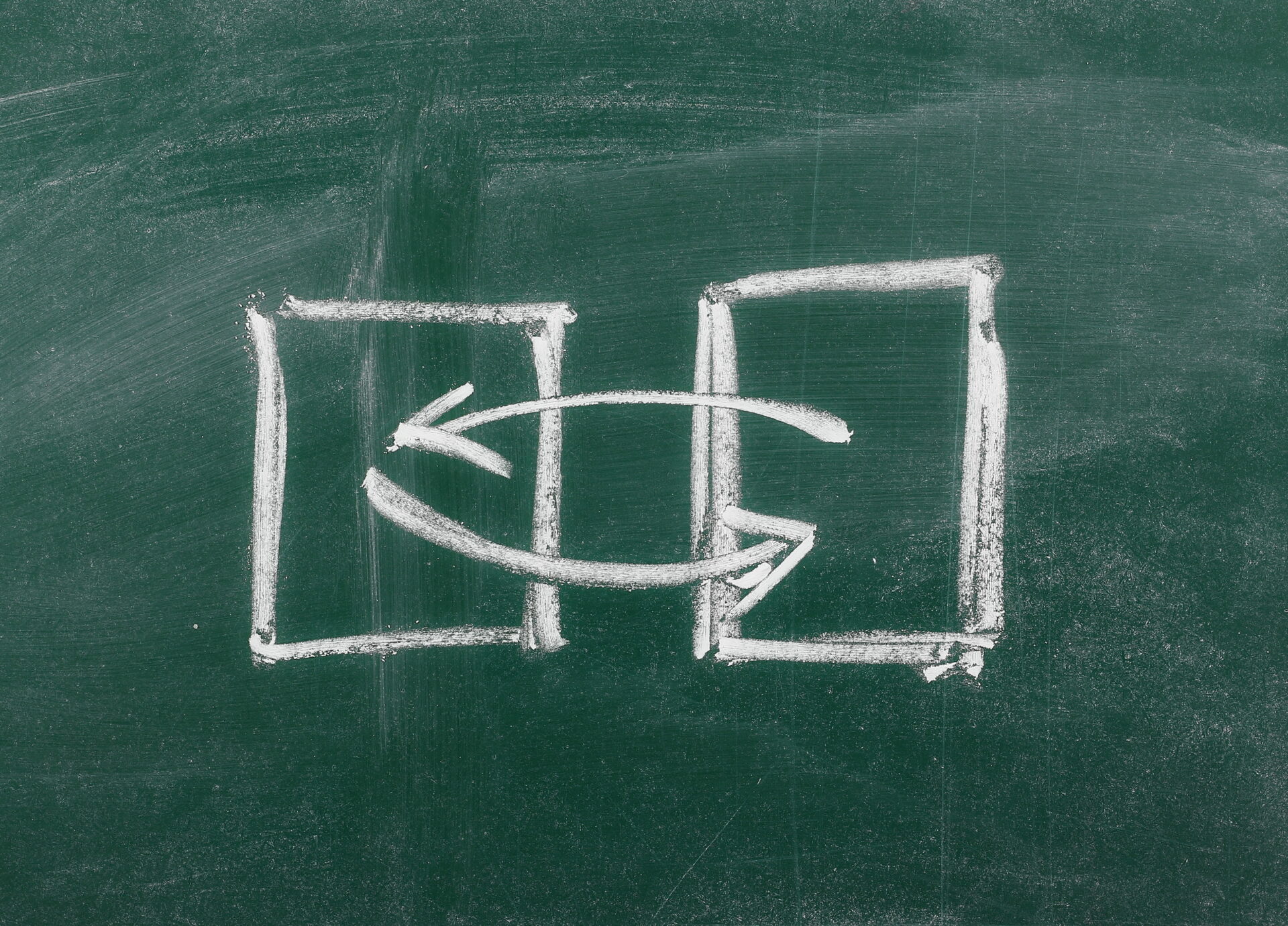

When it comes to real estate investing, understanding 1031 exchanges doesn’t have to be complicated. Let’s break it down into three essential components that every investor should know – we’ll call them the ABC’s of 1031 exchanges. This simple ABCs guide to 1031 exchanges will clarify the process.

Assess Your Assets

The first step in any successful 1031 exchange is assessing your current investment property. This means understanding not just its market value, but also its potential capital gains tax implications if sold traditionally. Remember, a 1031 exchange works only with investment or business properties – your primary residence won’t qualify. Take time to evaluate whether your property meets the basic requirements and if an exchange aligns with your investment goals as described in this ABCs guide for 1031 exchanges.

Build Your Timeline

Once you’ve decided to proceed with a 1031 exchange, timing becomes critical. You’ll need to work within two key deadlines that the IRS strictly enforces:

- 45 days to identify potential replacement properties after selling your current property

- 180 days total to complete the entire exchange process

Missing these deadlines isn’t just inconvenient – it could disqualify your entire exchange and trigger immediate tax liability. That’s why building a realistic timeline and sticking to it is crucial for success. Using this abc guide 1031 exchanges can help you plan effectively.

Choose Your Team

Here’s a truth that successful investors know well: a 1031 exchange isn’t a solo journey. You’ll need a qualified team to guide you through the process. This includes:

- A Qualified Intermediary (QI) to handle the exchange funds and documentation

- A knowledgeable real estate agent familiar with 1031 exchanges

- Tax advisors or CPAs to help evaluate the financial implications

The right team can help you avoid common pitfalls and ensure your exchange meets all IRS requirements.

Remember, while these ABC’s provide a foundation for understanding 1031 exchanges, each investor’s situation is unique. The key is starting with these basics and then building your knowledge from there.

Whether you’re considering your first exchange or your fifth, having a clear grasp of these fundamentals will serve you well throughout the process. This abc guide 1031 exchanges is here to help you every step of the way.

Want to learn more about how a 1031 exchange could benefit your investment strategy? Contact our team at 888-508-1901 for a consultation. We’re here to help you navigate every step of the exchange process, from initial assessment to successful completion.

Same-Day Drop and Swap Survives in New York: What Real Estate Investors Need to Know

Real Estate Agents and 1031 Exchanges: A Crucial Partnership